The global world of celebrity buyers is certainly one of high risk and excessive praise. Today, I will talk about the lives of nine traders from this niche, and examine their techniques, successes, and tricks.

From the legendary Jesse Livermore to the controversial Nick Leeson, I will break down whether these celebrities have made money through their buying and selling businesses.

1. Jesse Livermore

Jesse Livermore’s story is a traditional boom-and-bust story. Livermore, born in 1877, made his fortune by shorting the stock market during the crash of 1929, amassing more than $100 million.

However, by using 1934, he lost all of that. Its existence, marked by dramatic currency collapses in the USA, ended tragically in 1940.

Key achievements

- 1929 Market Crash: Shorted the market and made a huge fortune.

Recurring Financial Turbulence: Despite initial success, suffered huge losses later in life.

The story of Livermore is a testament to the volatile nature of trading, where fortunes can be made and lost in the blink of an eye.

To avoid such issues, and if you want to discover the sensible components of trading, platforms like Axiory offer a range of equipment and resources that could help novice and experienced buyers on their funding journey.

2. William Delbert Gann

William Delbert Gann (1878–1955) became not only a dealer but a pioneer in forecasting techniques.

He interwoven geometry, astrology, and historical arithmetic to predict market movements. At his demise, his estate was valued at over $100,000 – a vast sum for the technology.

A unique approach

- Prognostic methods: He used unconventional strategies involving geometry and astrology.

- Property Valuation: The price of his property at his death highlighted his business success.

Gann’s method, while unconventional, shows the different strategies investors use to navigate the markets.

3. George Soros

George Soros, born in 1930, is perhaps one of the most famous buyers. A holocaust survivor, he later earned the nickname “the man who broke the Bank of England” in 1992 and made $1 billion in short sales.

A remarkable achievement

- 1992 Profit: Makes an astonishing $1 billion by shorting the British pound.

Soros’s fulfillment story is one of resilience and acumen and demonstrates the ability to generate tremendous income in trading.

4. Jim Rogers

Jim Rogers, Jr., born in 1942, is known for co-founding the Quantum Fund alongside George Soros.

His notable bullish approach to commodities in the 1990s and extensive global travels in search of financial opportunities have established him as a key figure in international trading.

Major investment event

- Quantum Fund: Co-founded with George Soros.

- Commodities Bull: Successfully predicted the commodities boom.

Rogers’ adventurous method of investing illustrates the importance of a global approach to trading.

5. Richard J. Dennis

Richard J. Dennis (born 1949), the “Prince of Mines,” started with just $1.600 and turned it into a $200 million fortune by buying and selling commodities.

He is also known for Turtle Trading, which was designed to reveal that a hit of buying and selling can be discovered.

Business trip

- Initial investment: Starts with the most useful $1,600.

- Turtle Trading Experiment: Co-created a revolutionary trading experiment.

Dennis’ story is an inspiration and shows that with the right method, even a small beginning can turn into a huge success.

6. John Paulson

John Paulson (b. 1955) made his billions by quickly selling off the US subprime mortgage market in 2007. However, he later faced significant losses in pharmaceutical, healthcare, and gold stocks.

Business record

- 2007 Subprime Market: Billions Made by Quick Selling.

- Later Losses: Suffered losses in various sectors.

Paulson’s story is a reminder that even the most successful investors can face setbacks.

7. Steven Cohen

Steven Cohen, born in 1956 and the founder of SAC Capital Advisors, experienced a significant challenge when his firm was hit with a $1.2 billion fine for insider trading in 2013. Despite this, he has continued to thrive in the industry as the CEO of Point72 Asset Management, marking a profitable and controversial career.

Controversy and successes

- Insider Trading Penalty: His corporation faced strong insider trading at its best.

- Enduring Career: This continues to be a massive asset control issue.

Cohen’s adventure illustrates the risks and ethical challenges in global business.

8. David Tepper

David Tepper, born in 1957 and the founder of Appaloosa Management, distinguished himself in the trading community with his expertise in distressed debt investing. His deep understanding of these unique investments has notably set him apart.

Specialization

- Distressed Debt Investing: Specializes in investing in distressed assets.

Tepper’s success in a niche region suggests diverse buying and selling opportunities.

9. Nick Leeson

Nick Leeson (born 1967) is known for causing the collapse of Barings Bank with losses of $1.4 billion. Interestingly, he later became the CEO of Galway United Football Membership.

A notorious legacy

- The collapse of Barings Bank: Responsible for huge monetary loss.

- Career Shift: Moving into a unique industry after a breakup.

Leeson’s story is a cautionary tale about the potential dangers of uncontrolled buying and selling practices.

How Has the Role of Technology Evolved in Shaping the Strategies of Successful Traders?

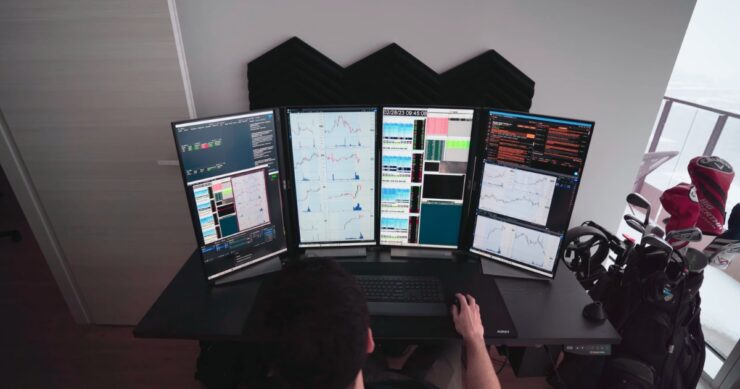

The evolution of technology has not only revolutionized the trading landscape, making it more efficient and accessible, but it has also paved the way for innovative platforms like Zintego, which stand at the forefront of this transformation. In contrast to the era when traders depended on paper charts and physical trading spaces, Zintego harnessed the power of AI, machine learning, and blockchain technology to offer its users unparalleled analytics, heightened security, and transparent transactions. This integration signifies a leap towards the future of trading, where technology not only facilitates but also enhances the strategic capabilities of traders.

With the advent of platforms, the role of technology in trading has become increasingly dynamic, introducing new avenues for traders to excel. This platform embodies the latest evolution in trading, where advanced software and algorithms empower traders to sift through enormous datasets in real-time, spot trends, and execute trades with unmatched precision and speed. This shift highlights the critical role of technology in enabling traders to adapt and thrive in an ever-changing market environment.

The rise of high-frequency trading (HFT) and automated trading systems exemplifies this technological prowess, executing transactions at volumes and speeds beyond human capacity. Moreover, various platforms democratize the financial markets, offering retail investors tools and opportunities once reserved for institutional traders.

This level playing field is further supported by online platforms and apps that provide instant access to market data, analytical resources, and the freedom to trade from anywhere, underscoring the importance of staying ahead in cybersecurity and system integrity.

FAQs

Can anyone become a successful businessman like these celebrities?

Success in buying and selling requires knowledge, risk management, and a bit of success regularly. While anyone can start buying and selling, replicating the fulfillment of these celebrities is difficult and not guaranteed.

Did any of these famous buyers have a financial history?

Not necessarily. Some had formal training in finance, although others learned through experience and self-education.

Are these trading strategies still applicable today?

Some techniques are immortal, however, market dynamics are constantly evolving, so it is important to constantly adapt and analyze.

Can buying and selling produce stable profits?

Trading earnings can be very volatile and are not always usually considered strong compared to standard income assets.

Is it really useful to follow the investment strategies of these investors?

While learning from their strategies can be beneficial, it’s important to adapt them to modern market conditions and your personal risk tolerance.

Were these buyers solo buyers or part of larger teams?

Many started as solo buyers but ended up commanding massive teams or established investment firms.

Final Words

These ten stories of traders illustrate the dynamic and regularly unpredictable nature of the trading world. From stunning gains to dramatic losses, their journeys show the complexities of building wealth in trading.

Whether through traditional techniques or unconventional strategies, every trader enjoys a valued perspective on the risks and rewards of the financial markets. After exploring the financial strategies of celebrities in trading, grasp essential insights into successful crypto shorting with these expert tips.

Related Posts:

- Ballantine whisky Price in India 2024: Get Your…

- What Is the Fastest Way to Make Gold in WoW? Tips Inside

- How to Make Olive Oil: A Beginner's Guide with 5 Pro Tips

- Side Hustle for Sports Fans: 10 Tips for Making…

- OSRS Money-Making Tips and Tricks: Epic Secret for…

- Becoming a Celebrity and Building Your Brand: 10…